Steel is the bedrock of industrialization, yet China’s vast steel sector stands at a critical juncture. The era of relentless expansion is giving way to an imperative for ”reduction-based development”—a strategic shift where survival hinges on disciplined capacity control and a fundamental transformation towards higher quality and sustainability.

The Chinese steel industry, producing over half of the world’s steel, is navigating its most profound transition. Data from 2024 reveals a telling trend: while crude steel output saw a slight decrease to 1.005 billion tons, the domestic apparent consumption fell more significantly to 892 million tons, highlighting a market where supply continues to outpace demand. This core contradiction of ”stronger supply versus weaker demand” is reshaping the industry’s entire operational logic, moving beyond volume towards value.

01. Core Challenges: The Impetus for Deep Adjustment

The industry’s pressures are multifaceted. Profitability has been severely challenged, with industry profits declining by 42.6% year-on-year in 2024. A fundamental shift in steel consumption patterns is the root cause. Demand from the traditional construction sector is declining sharply, and the growth in industrial materials (e.g., for automobiles, machinery) is insufficient to bridge the gap. This structural change in demand is intense and persistent, making supply-demand imbalance the primary constraint on development.

Compounding these challenges are complex external factors, including growing international trade tensions and increasing scrutiny from policies like the EU’s Carbon Border Adjustment Mechanism (CBAM), which create uncertainties for exports.

02. Strategic Roadmap: The Government’s Policy Framework

In response, the Chinese government has articulated a clear strategic direction. The Steel Industry Steady Growth Work Plan (2025-2026), issued by five ministries including the Ministry of Industry and Information Technology (MIIT), sets an annual growth target of about 4% for industry value-added, focusing on ”steady growth and preventing involution”.

The plan moves beyond one-size-fits-all approaches by introducing a sophisticated Three-Tier Classification System for steel producers. This system categorizes enterprises as:

- Leading Standard Enterprises: Advanced, efficient producers eligible for preferential resource allocation.

- Standard Enterprises: Compliant facilities undergoing gradual transformation.

- Non-compliant Enterprises: Outdated, inefficient operations targeted for accelerated elimination.

This classification aims to precisely guide resource allocation, supporting advanced enterprises while forcing backward capacity to exit.

Key policy levers include:

- Strict Control: A firm prohibition on new steel production capacity and strict enforcement of production cuts for inefficient facilities.

- Precision Management: Linking the classification system with policies on production, finance, and taxation to foster a “survival of the fittest” environment.

03. Key Transformation Pathways: High-End, Smart, and Green

The industry’s evolution is charted along three interconnected paths.

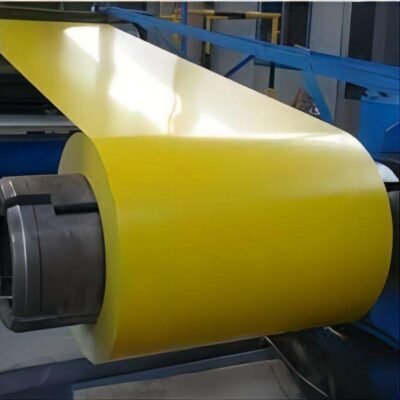

High-End Transformation: Moving Up the Value Chain

The focus shifts from volume to producing high-value-added steel products. The plan prioritizes the development of specialty steels for advanced manufacturing, such as high-performance bearing steel, gear steel, and high-temperature alloys for aerospace, reducing reliance on imports. This requires deep collaboration (Industry-University-Research) to tackle key technical bottlenecks.

Intelligent Transformation: Embracing Industry 4.0

Digitalization and smart manufacturing are crucial for future competitiveness. This involves:

- Smart Factories: Implementing AI-driven process optimization, predictive maintenance, and digital twin technologies to enhance efficiency and quality.

- Digital Supply Chains: Building platforms that connect producers and consumers for real-time market responsiveness. The plan explicitly supports developing a ”Steel Industry Large Model” and promoting ”AI + Steel” applications.

Green Transformation: The Low-Carbon Imperative

As the sector enters China’s national carbon market, decarbonization is a core priority. Key goals include completing ultra-low emission upgrades for over 80% of steel capacity by the end of 2025. The strategy encourages a shift from traditional blast furnace (BF) routes to more flexible and cleaner Electric Arc Furnace (EAF) steelmaking, which uses scrap steel. For the long term, there is significant support for R&D in breakthrough technologies like hydrogen-based metallurgy and carbon capture, utilization, and storage (CCUS).

Table: Core Environmental Targets for China’s Steel Industry (2025-2026)

| Indicator | Target / Focus Area | Strategic Importance |

|---|---|---|

| Ultra-Low Emissions | >80% of capacity to complete upgrades by end-2025 | Addressing historical pollution, meeting national environmental standards |

| Process Transition | Promote EAF development; support hydrogen metallurgy R&D | Reducing reliance on coal, leveraging scrap resources, exploring deep decarbonization pathways |

| Carbon Management | Inclusion in national carbon market; establish digital carbon management centers | Cost internalization of emissions, data-driven carbon reduction |

04. Expanding Demand and Ensuring Stability

The strategy also looks outward, aiming to expand application areas for steel. A key initiative is actively promoting the use of steel structures in residential and public buildings, bridges, and other infrastructure projects to stimulate domestic demand.

Internationally, the plan focuses on optimizing the export structure, shifting from low-value commodity steels to high-value-added products, and aligning with international standards to navigate trade tensions. The strategy also emphasizes securing raw material supplies by supporting domestic iron ore projects (with flexible regulation) and encouraging long-term supply contracts for coking coal to stabilize input costs.

05. Future Outlook: A Leaner, Stronger Industry

This comprehensive transformation is expected to lead to significant industry consolidation. Experts suggest that over the next 5-10 years, about one-third of steel enterprises may be forced to exit the market. The future landscape will be characterized by a smaller number of more efficient, technologically advanced, and environmentally responsible players.

The ultimate goal is to turn carbon pressure into a driver for technological innovation, market expansion, and brand enhancement, achieving a multi-dimensional win for the environment, economy, and society. The industry is being redefined not by the sheer volume of output, but by its quality, intelligence, and sustainability.

The journey ahead is complex. The success of this transformation hinges on consistent policy enforcement, significant technological investment, and the industry’s ability to adapt. However, the direction is clear: China’s steel industry is forging a new identity, aiming to become a global benchmark not for its size, but for its strength and sophistication.