The steel industry, often perceived as a traditional sector, is now at the forefront of a technological revolution driven by digitalization and sustainability.

In the heart of a modern steel plant, thousands of sensors and “smart neurons” are across production lines, while artificial intelligence calculates the most economical production formulas within seconds. This is not a scene from a sci-fi movie but a reality in today’s advanced steel industry. As we move through 2025, this vital sector is undergoing a remarkable transformation, balancing its fundamental role in global infrastructure with an urgent push toward innovation and environmental responsibility .

1. The Rise of the Smart Factory: Where AI Meets Steelmaking

The concept of the smart factory represents a paradigm shift in steel production. Companies like Nanjing Steel in China have successfully created digital twins of their physical operations, enabling unprecedented control and optimization. In these facilities, every aspect of production is monitored in real-time, creating a seamless connection between the physical and digital worlds .

The operational benefits are substantial. For instance, when an order for wear-resistant steel enters the system at Nanjing Steel’s intelligent plant, AI calculates the optimal production formula within 30 seconds. This formula considers the most economical ore mixing from sources as diverse as Australia and Africa, incorporates alloy components developed through smart research, and automatically switches production lines—all with minimal human intervention .

This digital transformation extends across the entire production chain:

- Real-time monitoring: Thousands of sensors collect data throughout the manufacturing process

- Predictive maintenance: AI algorithms anticipate equipment failures before they occur

- Customized production: Flexible manufacturing allows for economical small-batch production

- Resource optimization: Digital systems minimize waste and maximize efficiency

The results speak for themselves: a 20% reduction in processing costs and a 50% shorter production cycle demonstrate the powerful impact of these technologies on traditional manufacturing .

2. Specialized Steels: Driving Innovation Across Industries

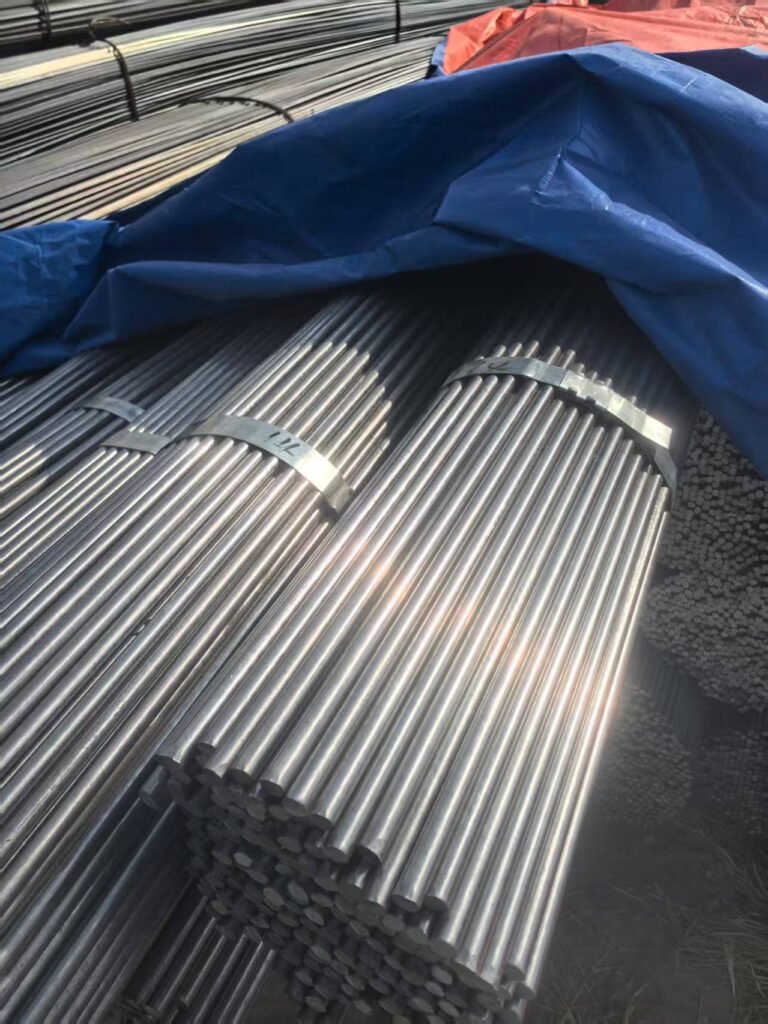

The steel industry’s evolution isn’t just about producing more steel—it’s about producing smarter, more specialized steels tailored to advanced applications. The market for high-performance steel grades like EN42J and C80 is expanding rapidly, driven by demand from precision engineering, automotive, energy, and tooling sectors .

Table: Specialty Steels and Their Applications

| Steel Grade | Key Properties | Primary Applications |

|---|---|---|

| EN42J | High durability, tensile strength, fatigue resistance | Springs, blades, measuring tools |

| C80 Steel | High carbon content, strength, durability | Automotive components, battery enclosures |

| Spring Steel | Returns to original shape after bending/twisting | Leaf springs, suspension systems, fastening mechanisms |

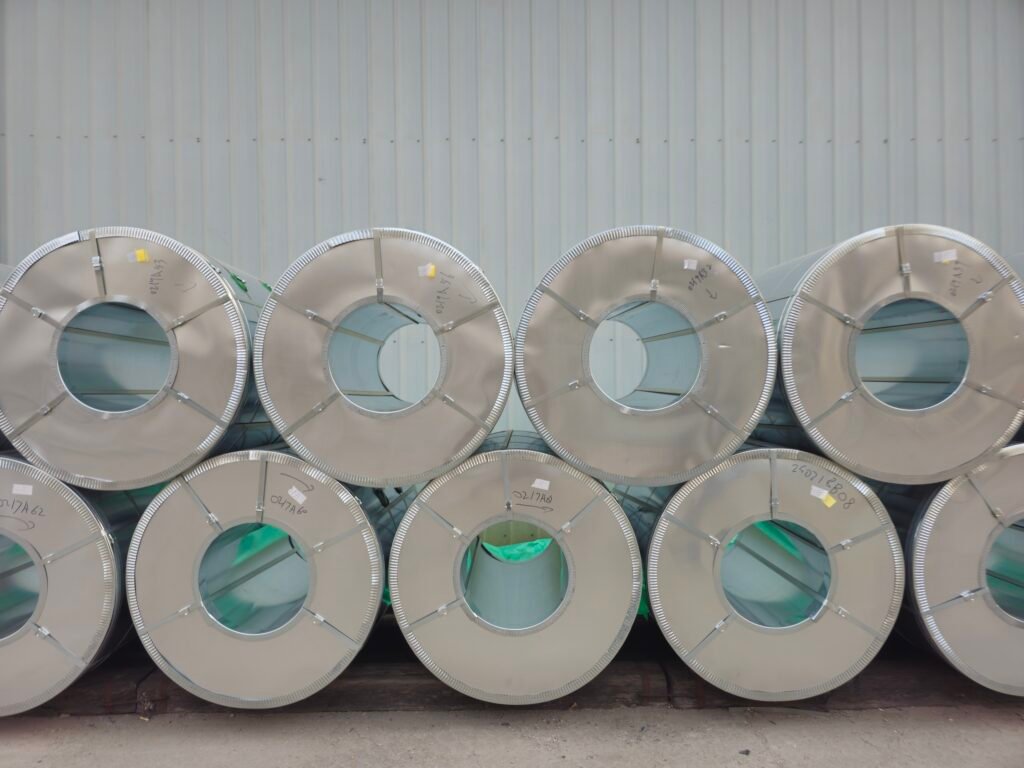

These specialized materials are becoming increasingly crucial to technological advancement. Spring steel, for instance, is experiencing growing demand particularly in India, where it’s essential for sophisticated industrial machinery, transportation systems, and mechanical products. The market for spring steel strip rolls is expanding as manufacturers seek ready-to-use materials in coiled or flattened forms for various applications .

The electric vehicle revolution represents perhaps the most significant driver of innovation in specialized steels. EVs require materials that combine light weight with exceptional strength, particularly for battery enclosures, suspension systems, and drive mechanisms. High-tensile steels like C80 are gaining traction in these applications, pushing manufacturers to develop new alloys with enhanced properties .

3. The Green Steel Transition: Decarbonizing a Carbon-Intensive Industry

Sustainability has become an imperative for the steel industry, with companies investing heavily in technologies to reduce their environmental footprint. The transition to green steel represents one of the sector’s most significant challenges and opportunities in 2025 .

Table: Green Steelmaking Technologies

| Technology | Description | Environmental Benefit |

|---|---|---|

| Electric Arc Furnaces (EAFs) | Use scrap metal rather than virgin ore | Reduces mining impact, lowers energy use |

| Hydrogen-Based Direct Reduced Iron (DRI) | Hydrogen replaces carbon as reducing agent | Minimizes or eliminates CO2 emissions |

| Waste Heat Recovery Systems | Capture and reuse excess heat from processes | Improves overall energy efficiency |

Leading steel producers are increasingly adopting Electric Arc Furnaces (EAFs) that primarily use recycled scrap metal, reducing the industry’s reliance on virgin materials. Meanwhile, the promising development of hydrogen-based direct reduction technology offers a pathway to dramatically lower carbon output, potentially revolutionizing primary steel production in the coming years .

The industry is also making strides in circular economy practices. The inherent recyclability of steel—where used products can be remelted and transformed into new high-quality materials—is being optimized through advanced sorting and processing technologies. This circular approach is embodied in modern steelmaking philosophy, where “used steel becomes red steel again after heating and smelting, creating an endless cycle” that maximizes resource efficiency .

4. Global Market Dynamics: Challenges and Opportunities

The steel industry operates in a complex global landscape characterized by both significant challenges and substantial opportunities. Understanding these dynamics is essential for grasping the sector’s trajectory in 2025 .

4.1 Persistent Challenges

Despite technological advancements, the industry faces several headwinds:

- Raw material volatility: Fluctuations in the availability and cost of iron ore, coking coal, and ferroalloys continue to impact production costs, particularly for special steel manufacturers who depend on imported materials with consistent quality .

- Environmental regulations: As countries tighten emissions standards, compliance costs are rising. Steelmakers must balance production with sustainable practices, requiring substantial investments that may strain smaller players .

- Workforce transformation: Modern steelmaking requires a tech-savvy workforce proficient in automation, AI, and advanced metallurgy. Bridging the skills gap between traditional steelmaking and digital technologies remains a critical challenge .

4.2 Growth Opportunities

Despite these challenges, significant opportunities are emerging:

- Global infrastructure development: Massive investments in smart cities, transportation networks, and energy grids across Asia, Africa, and Latin America are driving demand for both structural and specialty steels .

- Strategic market positioning: Governments worldwide are encouraging import substitution and self-reliance, creating opportunities for domestic producers to capture market share while boosting exports .

- Defense and aerospace applications: These sectors require ultra-durable, corrosion-resistant materials, creating specialized markets for advanced steel products .

5. The Road Ahead: Integration and Adaptation

As the steel industry looks beyond 2025, several trends suggest a continued evolution toward greater integration and adaptability. Companies are increasingly viewing themselves not just as steel producers but as integrated materials solutions providers, offering tailored products and technical support alongside basic manufacturing .

The concept of ”digital ecosystem building” is gaining traction, where steel producers create platforms that connect customers, suppliers, and manufacturers in a seamless network. Nanjing Steel’s approach exemplifies this trend, with their executive noting that “we are building a digital industrial ecosystem where many clients can directly input orders remotely on the industrial internet platform” .

The industry’s future will likely be characterized by several key developments:

- Enhanced customization: Advanced manufacturing technologies will enable more product specialization for specific applications

- Deeper digital integration: AI and IoT technologies will penetrate further into all aspects of production and distribution

- Circular economy emphasis: Recycling and resource efficiency will become central to business models

- Collaborative innovation: Partnerships between steel producers, technology companies, and research institutions will accelerate

This transformation reflects a broader shift in industrial philosophy. As one industry veteran involved in brand design for steel companies noted, inspiration often comes from understanding both the technical and human aspects of steel production—from the elegant symbolism of corporate identity to the practical challenges of manufacturing .

Conclusion: Strength Through Transformation

The steel industry’s journey through 2025 demonstrates that even the most traditional sectors can reinvent themselves through innovation and adaptation. By embracing digitalization, sustainability, and specialization, steel producers are not only improving their efficiency and environmental performance but also expanding their role in enabling technological progress across the economy .

The transformation underway—from AI-driven smart factories to hydrogen-based green steel production—suggests a promising future for this essential industry. As it continues to evolve, the steel sector will remain fundamental to global development, but in increasingly sophisticated and sustainable ways that align with 21st-century imperatives .

The words of a steel industry professional capture this evolution well: “Understanding the enterprise, accumulating experience, and having emotional bonds with the company provide the source of design inspiration and the greatest advantage.” This combination of tradition and innovation, of physical expertise and digital transformation, defines the steel industry’s path forward in 2025 and beyond .