Green steel—steel produced with significantly lower carbon emissions than traditional methods—represents a monumental opportunity for Africa. The continent is not pursuing a single path but is instead leveraging its diverse natural resources and industrial bases to explore multiple routes towards sustainable steel production. This article explores the distinct strategic approaches emerging across Africa, highlighting how different countries are capitalizing on their unique advantages to position themselves in the future global low-carbon economy .

☀️ The Foundational Advantage: Sun, Wind, and Ore

Africa’s potential in green steel is underpinned by three fundamental assets:

- Abundant Renewable Resources: As the “sun continent,” Africa possesses nearly 40% of the global solar potential and has enough wind resources to power its current electricity demand 250 times over. This provides the essential low-cost, clean energy required for producing green hydrogen, a key reducing agent in green steelmaking .

- High-Quality Iron Ore: The continent holds some of the world’s largest undeveloped high-grade iron ore deposits. The Simandou mine in Guinea, for example, contains 2.4 billion tonnes of ore with an iron content exceeding 65%, which is ideal for the direct reduction process that eliminates the need for coking coal .

- Growing Domestic Demand: With current steel use per person at only about 24 kilograms (one-tenth of the world average), Africa’s own development needs promise a substantial future market for sustainably produced steel .

The following table contrasts the strategic approaches of several key African nations.

| Country/Region | Core Strategic Focus | Key Projects / Initiatives | Primary Technologies Embraced |

|---|---|---|---|

| Namibia | Green Hydrogen Pioneer | HyIron Oshivela plant (aiming for 15,000 t/year of DRI) . | Hydrogen-based direct reduction . |

| Mauritania | Green Iron & Pellet Producer | Partnership with ArcelorMittal for a 2.5M ton/year green pellet & DRI plant . | Direct Reduced Iron (DRI) production for export or further processing . |

| Angola | Gas-Fueled Transition | Leveraging abundant natural gas for lower-carbon steel production . | Gas-based DRI as a bridge technology towards fully green production . |

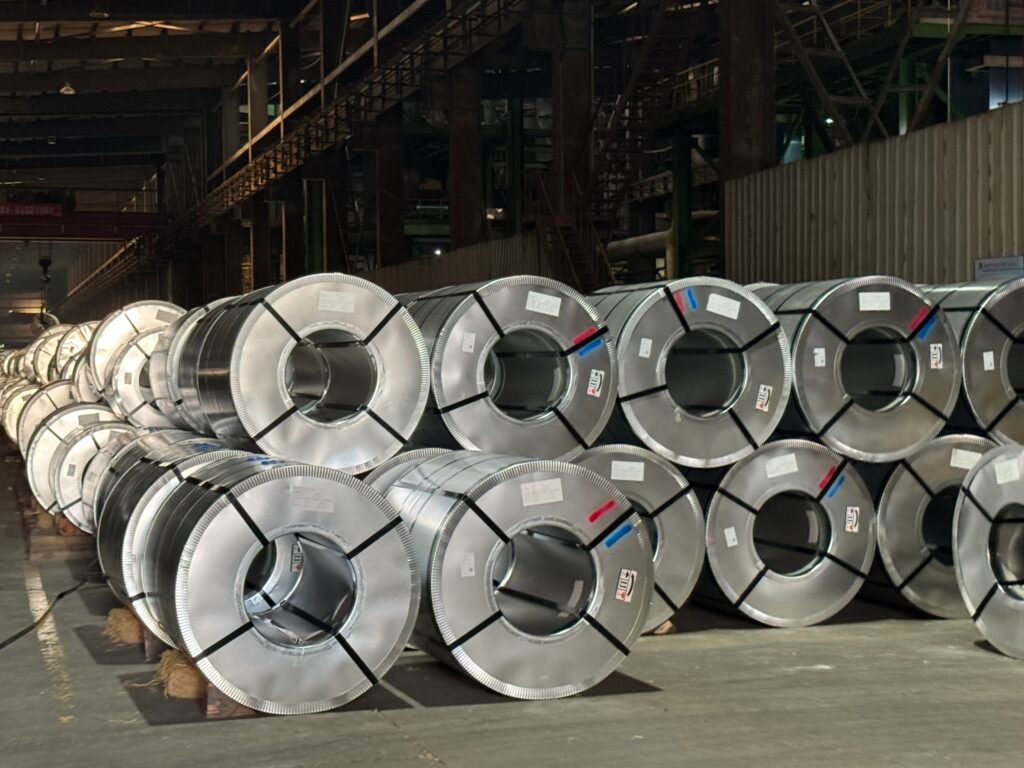

| South Africa | Industrial Base Modernization | Trials of green steel coils from Germany; exploring Carbon Capture and Storage (CCS) . | Electric Arc Furnaces (EAF) with scrap, and exploration of hydrogen-based DRI . |

| North Africa (e.g., Egypt) | Market Protection & Upgrade | Tariffs to protect local industry; investment in modernizing production facilities . | Integrating renewables into existing operations; increasing efficiency . |

🗺️ Diverse National Pathways

African nations are not taking a one-size-fits-all approach. Their strategies are sharply tailored to their specific resource endowments and industrial contexts .

- Namibia: The Green Hydrogen Leader Namibia is positioning itself as a frontrunner by directly coupling its superb solar resources with steel production. The HyIron Oshivela project, backed by the German government, aims to be Africa’s first commercial-scale green hydrogen-based iron plant. It plans to use solar power to produce hydrogen, which will then be used to convert iron ore into direct reduced iron (DRI) with virtually no carbon emissions. This establishes a foundation for a future green steel industry .

- Mauritania: The Green Iron Specialist As Africa’s second-largest iron producer, Mauritania is focusing on an intermediate step. Instead of immediately targeting finished steel, the national mining company SNIM is partnering with global giants like ArcelorMittal to develop facilities for green pellets and DRI. This strategy leverages its existing massive iron ore exports (13 million tons in 2022) by adding value to the raw material before shipping, a more achievable initial goal .

- Angola and Others: The Pragmatic Transitioners Some countries are adopting a more transitional model. Angola, for instance, is leveraging its abundant and low-cost natural gas to produce gas-based DRI. While not zero-carbon, this method generates roughly 50% lower emissions than traditional blast furnaces. It serves as a pragmatic “bridge technology” that builds industrial capability while moving toward lower-carbon production, with an eye on a future shift to green hydrogen .

- South Africa: Modernizing an Established Base With the continent’s most mature industrial sector, South Africa’s challenge is transformation. Its strategy includes experimenting with imported green steel for automotive components and exploring Carbon Capture and Storage (CCS) for its existing coal-dependent infrastructure. The focus is on increasing the use of scrap metal in Electric Arc Furnaces (EAFs) and planning for a future that includes hydrogen .

⚙️ Enabling Technologies and Critical Hurdles

The technological pathways emerging across Africa primarily involve:

- Direct Reduced Iron (DRI) with Hydrogen: This is the most promising long-term solution, using green hydrogen instead of coal to reduce iron ore .

- Electric Arc Furnaces (EAFs): Using renewable electricity to melt recycled scrap steel is a less energy-intensive alternative to traditional methods, suitable for urban centers with available scrap .

However, the vision faces significant challenges that must be overcome :

- Infrastructure Deficits: Perhaps the most immediate barrier is the lack of reliable infrastructure. Over 600 million people in Sub-Saharan Africa lack access to electricity, and transport networks are underdeveloped, increasing the cost and complexity of industrial projects.

- High Capital Costs and Financing: Green steel technologies require massive upfront investment. The higher costs compared to conventional methods, combined with perceived risks, make financing a critical barrier.

- Skills Gap: A shortage of technical expertise in new green steel technologies could slow down project development and operation.

🌍 The Global Context: Partnerships and Market Access

International partnerships and evolving global trade policies are key accelerators.

- The EU Carbon Border Adjustment Mechanism (CBAM): This mechanism, phasing in fully by 2026, will impose carbon costs on imports into the EU. For African producers who can establish green steel production, CBAM provides a significant future competitive advantage in the European market .

- Strategic Partnerships: Collaborations with international partners are crucial for technology transfer and financing. Examples include German support for Namibia’s HyIron project and partnerships between Mauritanian, Saudi, and European companies .

- The African Continental Free Trade Area (AfCFTA): This agreement can create larger, integrated markets within Africa, making large-scale green steel production more economically viable by reducing trade barriers .

💎 Conclusion: A Continent Forging Its Own Future

Africa’s green steel future is not a single story but a mosaic of strategic experiments. From Namibia’s hydrogen ambitions to Mauritania’s focused iron production and Angola’s gas-fired transition, the continent is actively exploring every avenue to leverage its natural wealth for sustainable industrialization.

While the hurdles of infrastructure, finance, and skills are substantial, the drivers—unique resource advantages, growing domestic demand, and supportive international policies like CBAM—are powerful. If African nations can maintain strategic focus and secure the right partnerships, they have the potential not only to build a sustainable industrial base for their own development but also to emerge as a major global force in the low-carbon economy of the 21st century .