Here is a detailed analysis of the specific differences in steel market development models between North Africa and Sub-Saharan Africa.

The African steel industry is not monolithic. It is characterized by distinct regional pathways, primarily shaped by resources, infrastructure, and strategic focus. The following table summarizes the core differences between the two regions.

| Feature | North Africa | Sub-Saharan Africa |

|---|---|---|

| Development Model | State-led & International Partnerships; Integrated, large-scale production focused on export potential and regional dominance. | Market-Driven & Foreign Investment; Fragmented growth, largely targeting domestic construction demand with smaller-scale mills. |

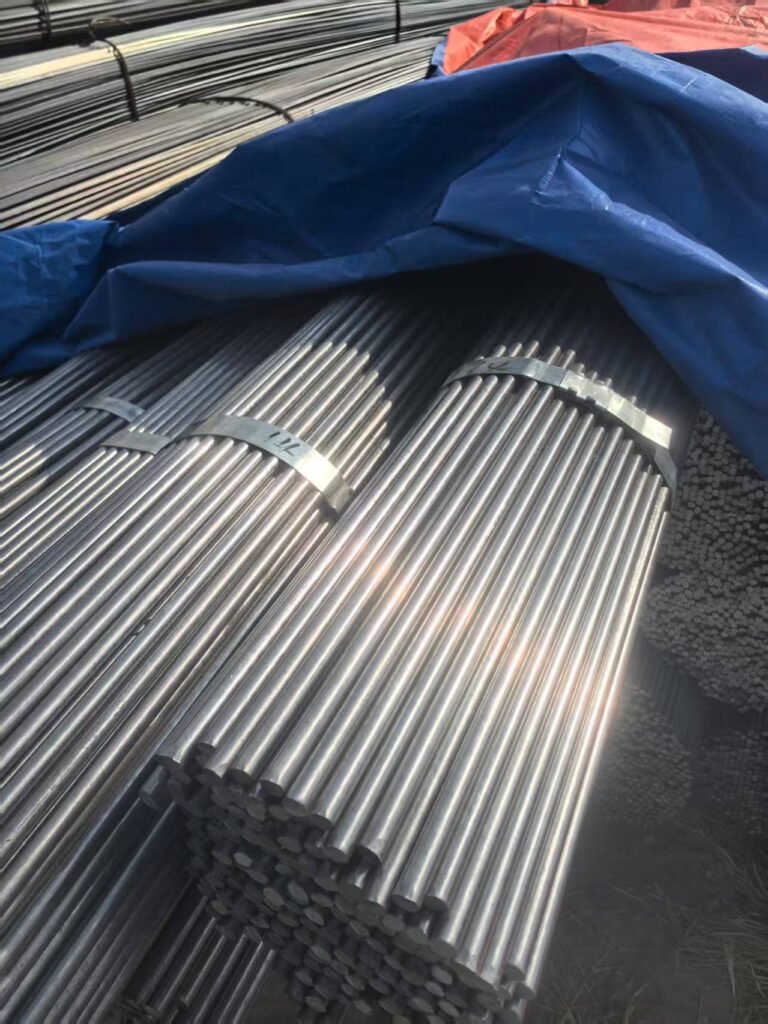

| Industrial Focus | Scale and Export Orientation. Focus on flat products (plates, coils) and value-added goods like heavy sections and rails. | Localized Consumption. Dominated by long products (rebar, wire rod) for construction, with limited high-value production. |

| Technology & Inputs | Natural Gas-Based DRI-EAF. Leverages abundant natural gas for Direct Reduced Iron, a cleaner primary steelmaking route. | Scrap-Based EAF. Relies heavily on electric arc furnaces using scrap metal, suitable for smaller markets but dependent on scrap availability. |

| Key Players & Investment | Turkish, Qatari, and Egyptian conglomerates (e.g., Tosyalı, Qatar Steel, Ezz Steel). | Diverse Chinese investments (from large firms like Tsingshan to numerous SMEs) and local entrepreneurs. |

🏭 North Africa: Scale, Integration, and Strategic Partnerships

North Africa’s steel industry is relatively mature and integrated into global markets.

- Established Production Hubs: Egypt is Africa’s largest steel producer, with a output of 10.7 million tons in 2024. However, the region faces a paradox: while overall production capacity is high, countries like Egypt still need to import high-grade and specialty steels, indicating a gap in technological sophistication.

- Leveraging Resource Advantages: Algeria exemplifies a strategic model of using its natural gas reserves and proximity to the Mediterranean to attract foreign direct investment. By partnering with Turkish and Qatari companies, it has rapidly built large, integrated complexes with capacities exceeding 6 million tons, focusing on DRI-EAF technology.

- Export Ambitions: The focus on large-scale production and value-added products like the 54E rail produced in Egypt positions North Africa as a potential export hub for Europe, the Middle East, and other African markets.

🌱 Sub-Saharan Africa: Fragmented Growth Driven by Local Demand

In contrast, Sub-Saharan Africa’s steel market is more fragmented, characterized by numerous small-scale operations focused on immediate domestic needs.

- Addressing the Infrastructure Gap: The primary driver is immense, unmet demand for construction steel due to massive infrastructure deficits. For example, Nigeria’s annual steel demand is estimated at 17 million tons, but local production is only 2.2 million tons, creating a huge market for local producers and imports.

- The Rise of Small-Scale Mills: Countries like Nigeria, Ethiopia, and Tanzania host dozens of small steel companies. These enterprises typically operate smaller electric arc furnaces, recycling scrap to produce rebar and other long products for local builders. This model is agile and fills a critical need but lacks the economies of scale of North African plants.

- The Role of Chinese Investment: Chinese enterprises, ranging from large corporations like Tsingshan (in Zimbabwe) to small and medium-sized enterprises (SMEs), are pivotal. They often bring flexible business models, building 100,000-ton-level mills that can produce a diverse range of basic products from wire rod to nails, perfectly adapted to the fragmented and price-sensitive market.

💡 Contrasting Futures: Green Steel vs. Market Consolidation

The future trajectories of the two regions also diverge significantly.

- North Africa’s Green Transition: With a foundation in natural gas, North Africa is poised to be a leader in “green steel.” Gas-based DRI is a logical stepping stone towards using green hydrogen as a reducing agent. This positions the region to future-proof its industry and comply with increasingly strict environmental standards, such as the EU’s Carbon Border Adjustment Mechanism (CBAM).

- Sub-Saharan Africa’s Development Challenge: The immediate future for Sub-Saharan Africa is less about green technology and more about overcoming fundamental hurdles: unreliable energy supplies, poor transport infrastructure, and competition from cheaper imports. Success will depend on improving infrastructure, implementing supportive policies, and attracting investments that can gradually increase scale and technical capability.

In summary, while both regions are growing, North Africa is pursuing a path of strategic, large-scale integration into global value chains, whereas Sub-Saharan Africa is experiencing a more organic, demand-driven expansion focused on foundational construction needs. Their differing starting points and resources have led to these distinctly different development models.